nebraska property tax calculator

See example 1 above. The median property tax on a 10910000 house is 192016 in Nebraska.

Nebraska Sales Tax Small Business Guide Truic

Enter the dollar amount of taxes paid on each parcel on Form PTCNebraska Property Tax Incentive Act Credit Computation.

. The top rate of 684 is about in line with the US. The Nebraska Property Tax Incentive Act provides a refundable income tax credit credit or credit against franchise tax imposed on financial institutions for any taxpayer who pays school district property taxes. Nebraska Property Tax Incentive Act Credit 182021 The NebFile for Individuals e-file system is closed for annual maintenance to prepare the system for the upcoming 2021 filing season.

Counties in Nebraska collect an average of 176 of a propertys assesed fair market value as property tax per year. Nebraska Income Tax Calculator 2021. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. The Registration Fees are assessed. Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year.

Nebraska has a progressive income tax system with four brackets that vary based on income level and filing status. Nebraska Property Tax Calculator to calculate the property tax for your home or investment asset. To make their tax information available online.

Nebraska launches new site to calculate property tax refund. To use our Nebraska Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Sarpy County is part of the Omaha metropolitan area and has the highest property tax rates of any Nebraska county.

WOWT By Gina. The single largest recipient of property tax dollars. Today property tax is the primary revenue raising tool for political subdivisions and in fiscal year 2018-2019 property tax revenue comprised approximately 374 percent of all state and local tax revenue collected in Nebraska.

This tax information is being made available for viewing and for payments via credit card. After a few seconds you will be provided with a full breakdown of the tax you are paying. A convenience fee of 235 100 minimum is included on all payments.

If you make 70000 a year living in the region of Nebraska USA you will be taxed 11756. Real estate taxes levied in arrears per Nebraska State Statute. Enter Property Value Choose the Property.

Property tax is calculated based on your home value and the property tax rate. Yes look for Property Owned by an Individual Tax Credit in the Nebraska tax section. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase.

Average for states with income taxes. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the NE property tax calculator. Nebraska launches online property tax credit calculator.

The counties on our site have made an agreement with MIPS Inc. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Our Nebraska Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the entire United States. Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a. Nebraska is ranked number seventeen out of the fifty states in order of the average amount of property taxes collected.

The first half of the 2020 taxes becomes delinquent April 1 2021 and the second half August 1 2021. Welcome to Nebraska Taxes Online. F_ptcpdf nebraskagovCalculate the refundable tax credit by multiplying the total allowable dollar amount of property taxes paid by 0253 and enter the amount on line 1 of Form PTC.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Lincoln County. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Income Tax Credit for School District Taxes Paid Nebraska Property Tax Incentive Act Click here to learn more about this free subscription service as well as sign up for automatic emails when DOR updates information about this program.

The median property tax on a 10910000 house is 114555 in the United States. If more than one year of property tax was paid in the income tax year a separate entry must be made for each property tax year. These monies were budgeted by all of the political entities at the end of the year to fund their budgets in 2021.

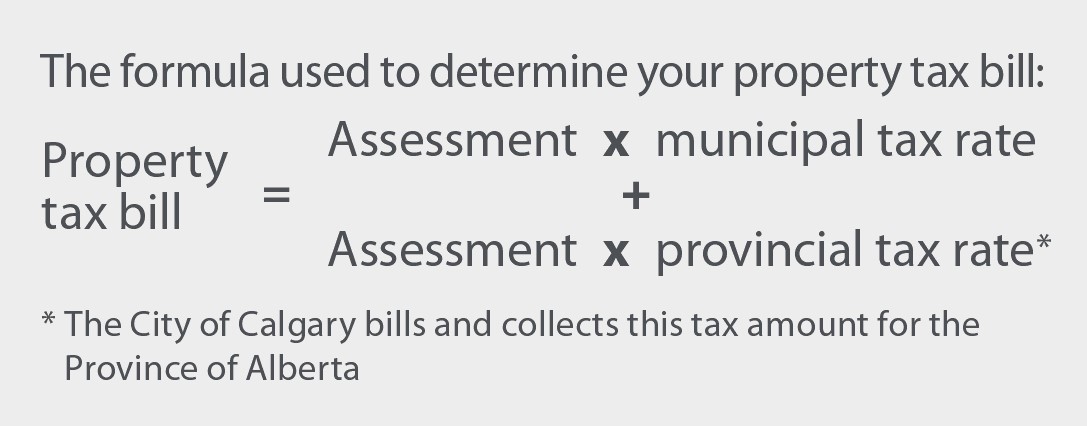

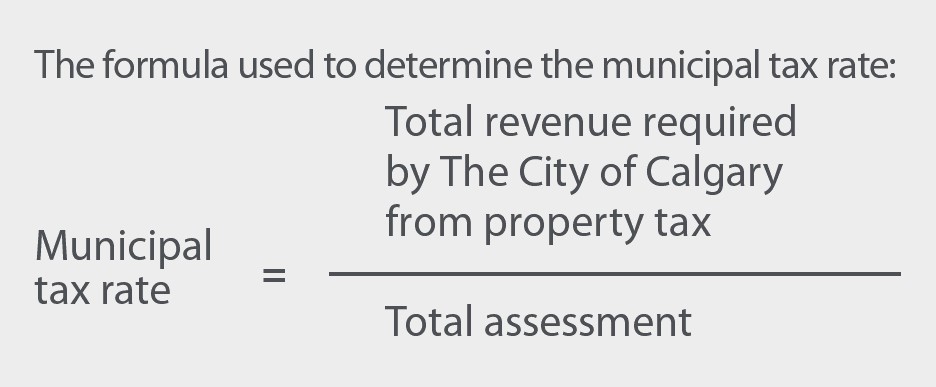

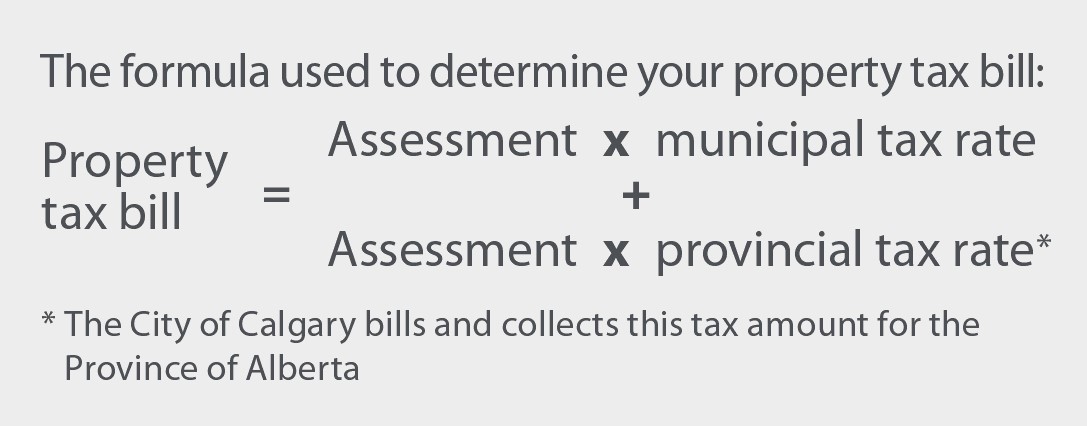

1500 - Registration fee for passenger and leased vehicles. Overview of Nebraska Taxes. Property tax calculation can be summarized by.

Most taxpayers pay their property tax in the year after the taxes were levied. Enter the property tax year for which the Nebraska school district property taxes were levied. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000.

Nebraska property tax calculator January 20 2021 Uncategorized No Comments January 20 2021 Uncategorized No Comments. The average effective tax rate in the county is 204 close to double the national average. The median property tax paid in Lancaster County is 3061 while the state median is just 2787.

Property tax Assessed Taxable Property x Rate Credits.

Property Tax Tax Rate And Bill Calculation

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

Property Tax Tax Rate And Bill Calculation

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Past Policy Maps Legislative Research Office

States With The Highest And Lowest Property Taxes Property Tax High Low States

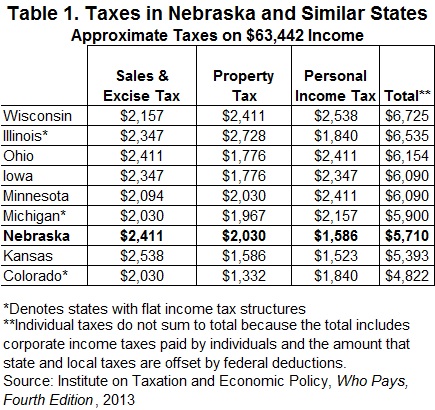

Taxes And Spending In Nebraska

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Harris County Tx Property Tax Calculator Smartasset

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Transfer Tax Calculator 2022 For All 50 States

Nebraska Property Tax Calculator Smartasset

Property Tax Tax Rate And Bill Calculation

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

2020 Nebraska Property Tax Issues Agricultural Economics